A Private Equity Firm’s Journey Taking ESG from Reporting Burden to Value Creation

Share:

The United States Securities and Exchange Commission (SEC) is poised to release its highly anticipated climate-related disclosure rules for public US companies – a ruling that has been in the making for over a year.

Originally published in March 2022, the SEC proposed that all publicly listed US companies be mandated to report their climate data in alignment with reporting recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD).

When the proposal was then opened for public comment, the SEC received over 3,400 letters, significantly more than it customarily does when seeking public input.

While the SEC ruling applies to public companies, given the current global regulatory environment, along with calls for greater scrutiny of ESG claims within the private equity industry, it is only a matter of time before similar climate considerations be asked of private funds. Moreover, although the proposal will almost certainly face some measure of legal challenges, this will likely not deter 98% of companies from implementing climate reporting, according to a PricewaterhouseCoopers survey of 300 senior executives at US public companies with at least $500 million in revenues.

A deeper look at the SEC Proposal

The SEC proposal aims to provide investors with consistent and comparable information with which to examine the sustainability and climate risk profile of potential investments. It is also wide-ranging, covering the disclosure of greenhouse gas (GHG) emissions, predicted climate risks, and sustainability transition plans. Some if its main disclosure provisions include:

- Scope 1 and 2 greenhouse gas emissions

- Scope 3 emissions if deemed material or included in an organization’s emissions reduction plan

- Potential risks to and material impacts on an organization resulting from climate change, aligned with TCFD disclosure recommendations

- Quantitative and qualitative financial impacts of climate-related events such as severe weather events

- Governance and risk management-related information including scenario analyses, physical risks, transition risks, transition plans and other climate-related programs such as the use of carbon offsets or internal carbon pricing

An opportunity for private equity?

Though the SEC proposal applies to public markets, there are three potential avenues for direct overlap with private markets:

- Publicly traded private equity firms: Private equity firms traded on the stock market, along with their portfolio companies, would be subject to SEC rules

- Private equity portfolio companies going public: When making an Initial Public Offering (IPO), SEC-mandated climate information would need to be disclosed

- Private equity firms that are Registered Investment Advisors (RIAs): If adopted, the Proposed Rules would be the first time that the SEC has required disclosure of a specific aspect of the investment process by Registered Investment Advisors (RIAs).

Critically, in contrast to public markets, private equity and venture capital markets have direct responsibility for the companies or start-ups they invest in, often holding board seats in these companies. This direct-stakes approach to raising capital, along with the responsibility to their own board members who typically have considerable wealth at risk, means private capital firms will be held to a far higher standard of accountability as ESG regulation continues to tighten worldwide. Venture capital firms, in particular, have an opportunity to integrate ESG into their portfolio companies from the get-go during the early stage of a company’s life cycle.

How can private equity prepare for the SEC’s disclosure rules?

Given the unique nature of private equity to position itself as an ESG leader, the following areas may be considered when formulating a climate accounting strategy:

- Begin with a baseline collection of solid, reliable and verifiable data before crafting strategies and policies. Data is the edifice upon which ESG strategy rests.

- Embed ESG considerations into all stages of the investment lifecycle, from pre-deal assessments to exit plans

- Conduct a gap analysis by reviewing all current disclosure policies

- Conduct an audit of all greenhouse gas emissions related to portfolio companies

- Consider greenhouse gas emissions resulting from the supply chain: prioritize those suppliers with strong ESG credentials

- Leverage technology solutions to streamline and automate ESG reporting

If you are a Private Equity firm that is also an RIA, further planning and consideration may be required when formulating your climate accounting strategy since an additional specific set of disclosure requirements will apply. In this case, you can prepare for the upcoming SEC disclosure mandate by:

- Determining the applicable fund category: Whether and how the SEC’s Proposed Rules will impact an RIA depends primarily on which of the 3 ESG fund types (i.e. “ESG Integration,” “ESG-Focused,” and “ESG Impact”) apply to the RIA’s investment decisions.

- Tailoring your marketing and advertising policies to the new ESG fund-type classification system: RIAs should be deliberate about the publication of marketing & sales collaterals that indicate the significance of ESG factors in investment decision-making, as this could unintentionally lead to enhanced disclosure obligations

- Creating consistent internal policies regarding the use of ESG metrics: seeing how a key focus of SEC’s Proposed Rules for RIAs is the consistency of disclosures in their prospectuses, annual reports and brochures.

Technology: the missing piece

Technology will play a paramount role in successful ESG compliance – a belief echoed by a majority of business leaders.

Keeping the needs of private capital investors in mind, ESGTree has developed several climate reporting tools to collect, analyze, and automate this data and simplify reporting.

These include:

- An automated TCFD reporting tool: ESGTree’s cloud-based software boils down the reporting process to 40 simple multiple-choice questions that, upon completion, automatically generate the TCFD report.

- An automated Partnership for Carbon Accounting Financials (PCAF) tool: Automating this framework allows organizations to calculate their financed emissions i.e. emissions associated with their loans and investments

- Carbon Calculator: ESGTree’s Carbon Calculator allows staff members themselves to generate Scope 1, 2 and 3 GHG emissions using basic information about company operations. Our clients have reported a 70% reduction in the time it takes to calculate this information.

The SEC’s climate disclosure rules do not exist in a vacuum. As more regulators across the world toughen ESG rules, consolidate standards and crack down on greenwashing, the private equity industry is well-placed to lead the transition to a more sustainable, low-carbon economy.

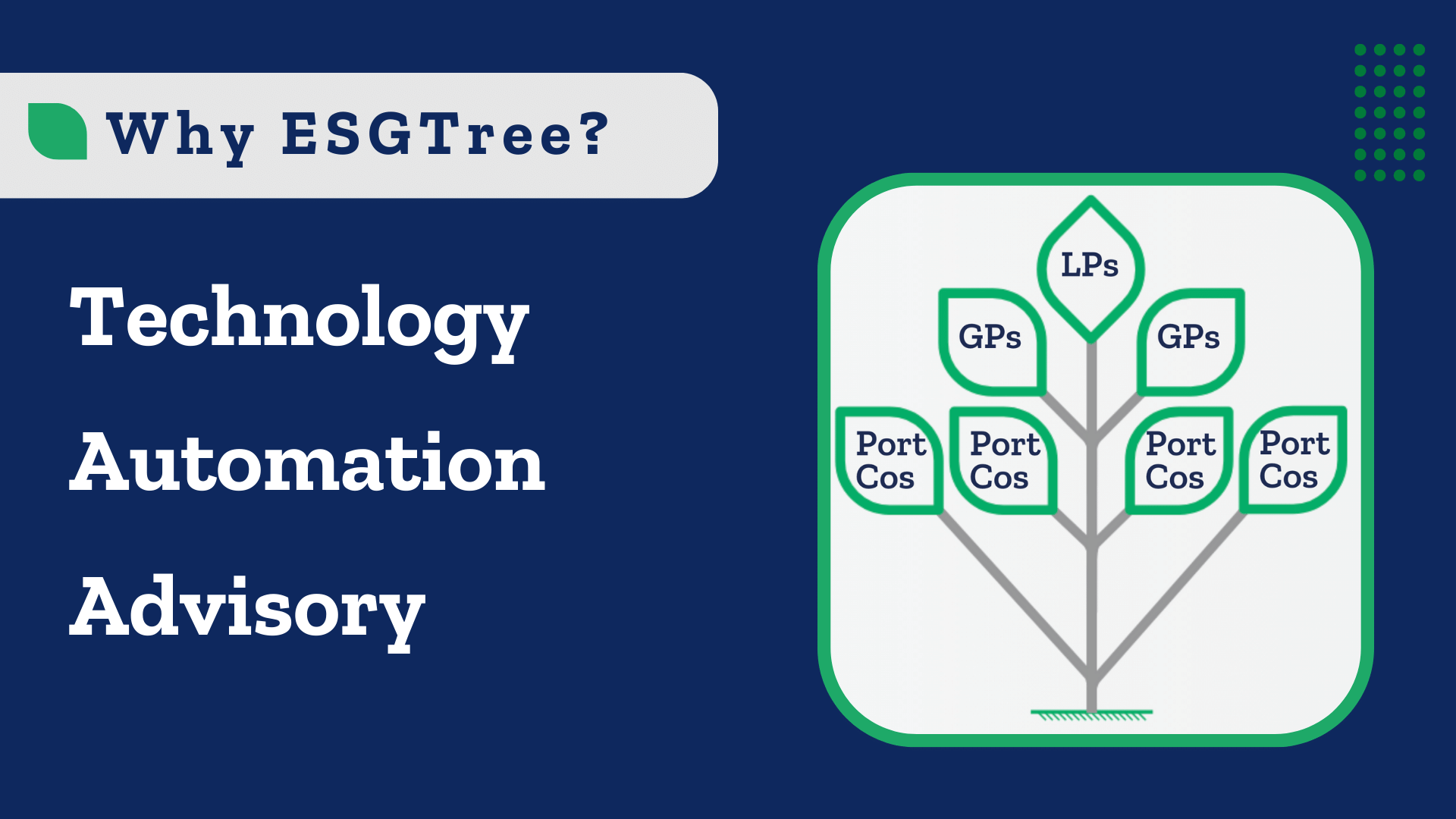

ESGTree provides powerful cloud-based data solutions to help private equity (PE) and venture capital (VC) firms gather, collect, analyze, benchmark and report their ESG data and that of their portfolio companies. Our carbon calculator, customizable and automated ESG frameworks, multi-level report viewing, trends analysis dashboard, and other features turn ESG into a value creation tool rather than a reporting burden.

Why Should Private Equity and Venture Capital Care About ESG?

Why ESGTree ? – Differences that Make a Difference

Who Should the Economy Really Serve?

What We’ve Learned Automating the ESG Data Convergence Initiative (EDCI) for Clients

Summary

Share:

What is the US SEC climate disclosure proposal?

Why should private equity care about the SEC climate proposal?

How can private equity prepare for the SEC’s disclosure rules?

How can technology be leveraged to report climate data?

Contact Us

Contact Us

info@esgtree-wp.septemsystems.com

Office Addresses

Canada: ESGTree, Kindred Centre for Peace Advancement, 140 Westmount Rd N, Waterloo,ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom